Capital One Canada Introduces Free Credit Score Checks for Cardholders **This is a sponsored post written by me on behalf of Capital One®. All opinions are my own.

Your credit score is an important part of who you are and a glimpse into your financial picture. I found this out the hard way through some financial mistakes made while in University. I wish I had known then how important your credit score is and I definitely wish Credit Keeper™ by Capital One® was available then!

What is a Credit Score?

Your credit score is a number between 300 and 900 which is based on information from your credit profile – often called a credit report. This report gives information lenders may want to know before offering you credit, whether that be a credit card, mortgage, student loan, car lease, cell phone or any other type of financing. The report outlines your payment history, the amount of credit you have available to you, how many credit accounts you have, how old the accounts are along with recent credit application activity.

A good credit score is a high number, and a poor credit score is the opposite. Sometimes credit scores can be confusing because it depends on which credit agency is calculating it and the way they calculate the overall score. It’s also important to remember that lenders may also consider things other than your score to make a determination about your application for credit (i.e. collateral). Overall, it’s important to understand what your credit score is and how to improve yours.

Credit Keeper by Capital One

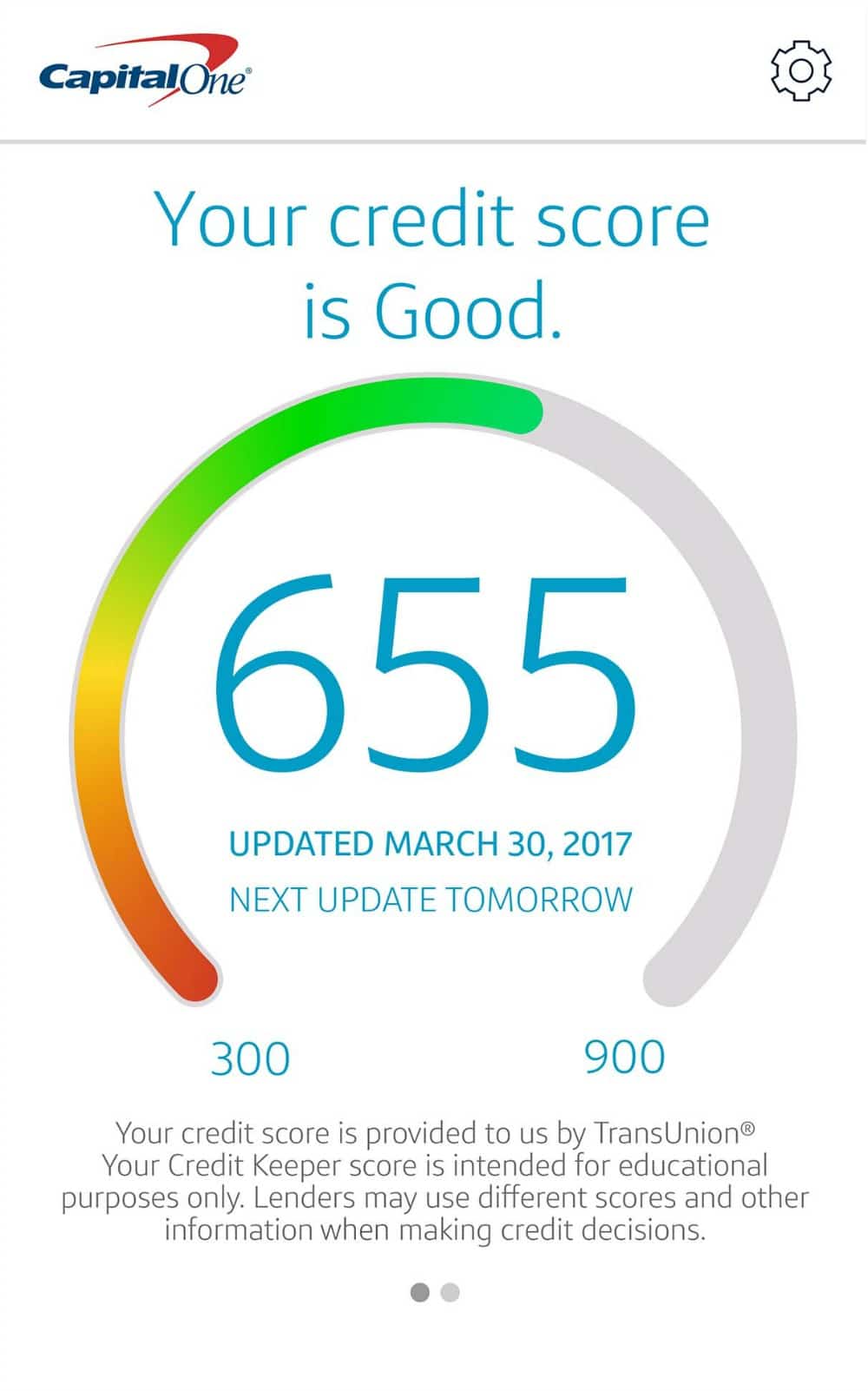

I’m so excited about a fantastic new tool called Credit Keeper by Capital One. Credit Keeper will provide you a free credit score and an overall description of their credit health. When you use Credit Keeper your score is updated each week, giving you an up-to-date picture of your credit health. The Credit Keeper score is calculated by TransUnion and uses your credit report to give a better picture of your credit health.

Credit Keeper will be rolling out in phases to Capital One Canada customers integrated through the Capital One Online Banking platform. Capital One is the first bank in Canada to offer free credit scores to its customers. Credit Keeper is just one example of how Capital One is innovating to build products and smart financial features for seamless interaction.

The best part about Credit Keeper? It’s simple and easy to use because it’s designed with you, the customer, in mind. When logging into your Capital One Online Banking, you will see a message that looks like the one below and help you to understand what your score means. The best part is you can see how your financial choices directly impact your credit score directly.

Credit Score Tips

Here are some tips from Capital One to help you protect, monitor, and improve your credit score:

Protect: Fraud and Identify Theft can damage your credit score. Make sure you are aware of your score, as it allows you to report any suspicious activity to your card issuer.

Monitor: Check your credit score regularly (especially if you have plans to apply for a loan, mortgage or new credit) so you know where you stand.

Improve: Using your credit responsibly. Paying bills on time and ensuring you pay at least the minimum payment each month is important for building and maintaining your credit score. Setting up automatic payments each month is an easy way to ensure you never miss a payment!

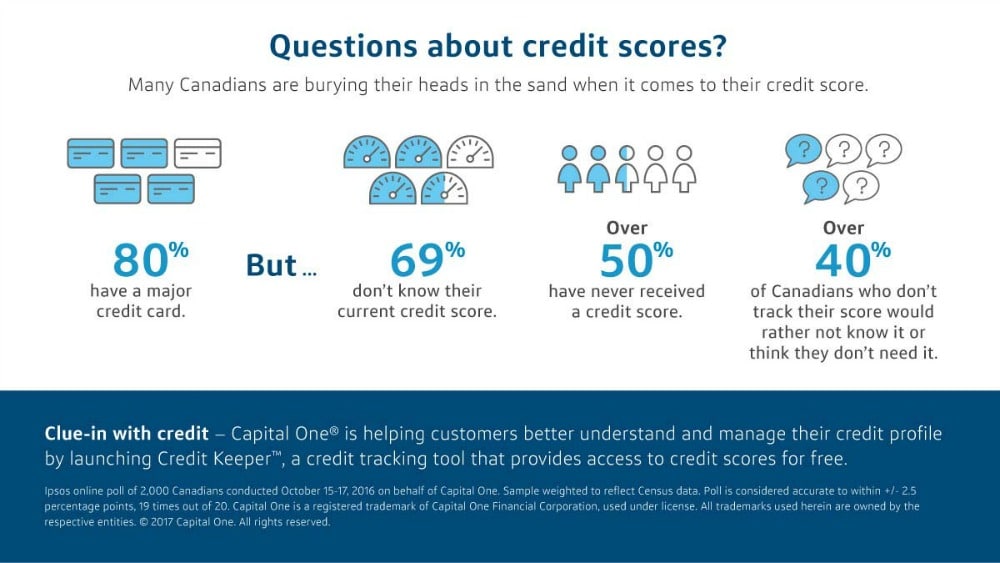

Taking the ostrich approach (burying your head in the sand) isn’t going to help you lead the life you want. With only 12% of Canadians checking their credit score yearly, Credit Keeper by Capital One is an essential tool and integrating it into its Online Banking platform allows you to keep all of your financial information together and easily accessible.

Let’s take our heads out of the sand and check our credit scores together!

*Credit Keeper is a service offered by Capital One and is powered by credit history and score information provided by TransUnion. Availability may vary depending on the ability to verify your identity and obtain your information from TransUnion. The credit score provided by Credit Keeper is intended for your educational use only. Lenders and other commercial users may use a different type of credit score and other information when making credit decisions. Currently, Credit Keeper isn’t available for Capital One customers who live in the province of Quebec, or who have a Capital One MasterCard exclusively for Costco members.

This is so important – and I know first hand as we recently purchased a new home and did some extensive renovations on it.

I love that now consumers are able to get their credit score directly instead of going to a bank or elsewhere to get it.

Knowledge is power – and the consumer should be in control!

What a great service! It’s so important to pay attention to your credit score and I like that this can be done easily.

This is a great way to see if your identity has been compromised as well. So good to keep an eye on this.

This will be really important, especially as we approach the time when we will be thinking about buying a house!

Heather recently posted..His & Hers Wood Watches (& Giveaway)

People underestimate the importance of their credit score! It is so important and Capital One is a great company to help with that.

I have Capitol One and have been loving how they share our credit score with us now! It is great to be able to keep an eye on my credit score to make sure nothing fishy is going on!

Yes! It’s such a fantastic feature.

It is important to know things about your credit score, as well as things that impact it like requesting certain things. It sounds like it will be very easy to access for customers.